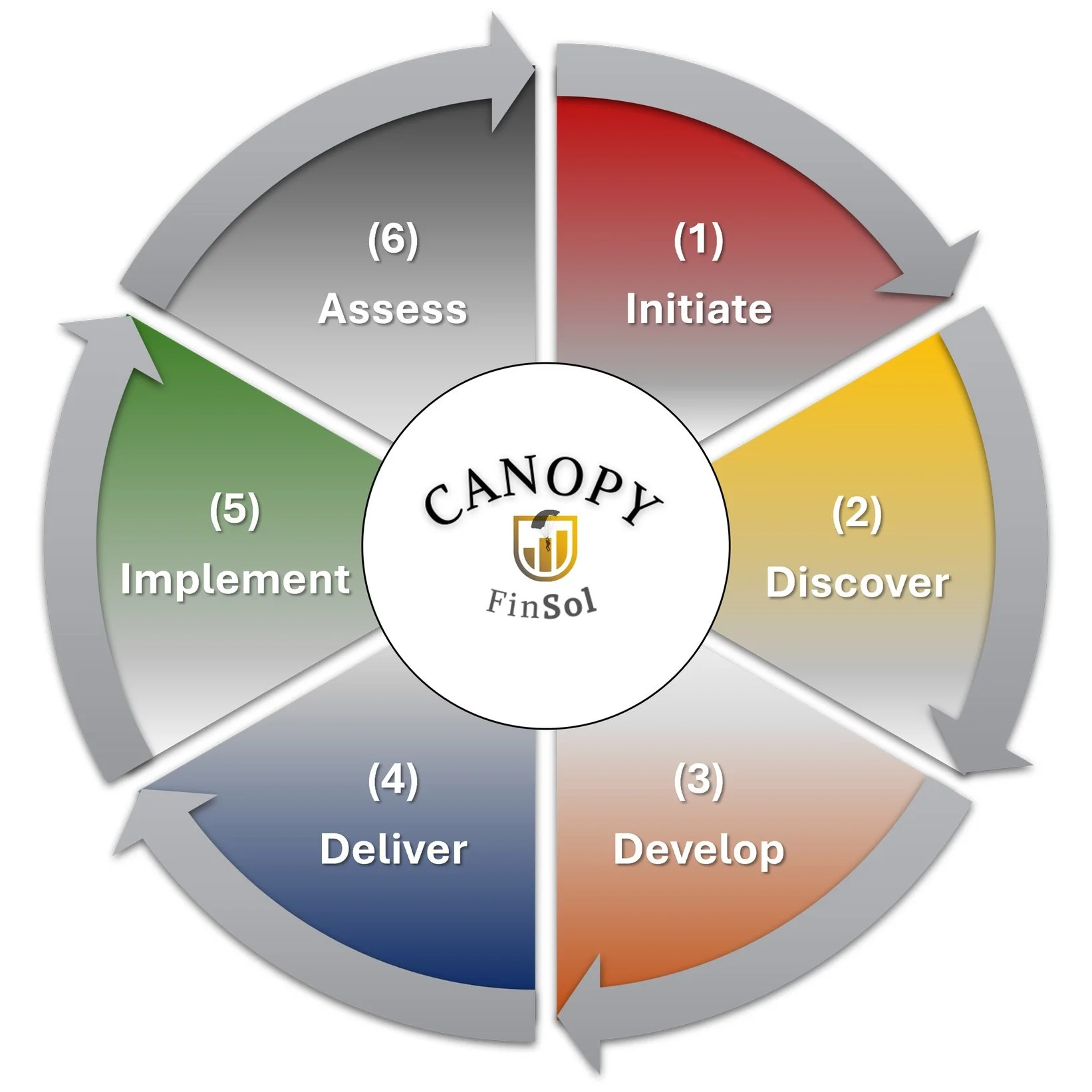

The Canopy FinSol Financial Planning Process

I hope to gain your trust and business, but not at the expense of your best interests or my integrity. As a Chartered Financial Consultant®, I follow a proven framework endorsed by the Certified Financial Planners® Board and other financial fiduciaries.

Canopy Financial executes this process differently for each client with a unique blend of personal perspective, modern client technology, and transparency.

At the end of the day, we are all asking the same question, “am I going to be ok both now and through retirement?”

Financial planning looks different for everyone. You don’t know what you don’t know. Let me help you find financial peace by working together on:

controlling your cash flow and building net worth

developing risk-appropriate “bucket strategies”

where to put your next dollar

maximizing your group benefits

protecting your most valuable assets

a growth and protection plan for your business / employees

determining retirement income needs

tax strategies and asset allocation that makes sense for you

understanding healthcare options and social security strategies

helping you GIVE generously and leave a legacy

This framework is the basis for all future client communications and engagements. You will always know where we reside within this process, whether it’s during new client onboarding or addressing new objectives and plan modifications throughout the year. As a fee-only Registered Investment Adviser, we do not sell any products so it helps to minimize potential conflicts of interest along the way.

-

Step 1: Initiate

First impressions are important. I strive to provide a welcoming and exciting client experience from the beginning. Using the Scheduling Link you can easily book your free consultation. During this free consultation, I'll give you a demo of our client resources and explain our planning process and investment philosophy.

The last 15 minutes are reserved for Q&A so we can learn more about each other and begin to refine your goals into actionable objectives and priorities.

-

Step 2: Discover

Following your free 45-min consultation, we’ll discuss the next steps and within 48 hours, you’ll receive a FINANCIAL PLANNING & ENGAGEMENT AGREEMENT that includes a summary of stated priorities, a general action plan, the terms of our relationship and any associated fees. Once electronically signed, client receives an invoice for agreed upon planning fees and I will get to work on your behalf promptly upon payment. You will gain access to your personal client dashboard, and be able to visualize your recommended pathway to success.

-

Step 3: Develop

Once our formal client-adviser relationship begins, I immediately begin developing the recommendations into prioritized strategies for implementation. At this point, you’ll receive expanded access to Savology and other client resources. We will use Savology and email to communicate requests for information needed to satisfy final planning inputs and client investment profiles. I will then send out a link to schedule our next formal meeting for plan delivery and presentation, or you can Click Here to Schedule Follow-Up & Delivery call.

-

Step 4: Deliver

The analysis and refinement from Step 3 results in a detailed plan created specifically for your goals. Your plan consists of a formal document (written in laymen’s terms) that matches each of your objectives to an actionable solution at a specific time. It will keep you on track and invested in your own growth. Your plan also includes continued access to digital client resources where you can have a consolidated view of your financial picture and monitor progress. During this phase we will clarify any of the recommendations and prepare for implementation.

-

Step 5: Implement

“A good plan, violently executed now is better than a perfect plan next week.” – Gen. George Patton

A professionally developed plan helps fend off a very influential Enemy of Wealth – emotions. But a plan only works when properly put into action. Your implementation timeline will include details for carrying out adviser recommendations — opening new accounts, securing insurance policies, other professional services, etc. You may choose your own implementation resources or rely on us for guidance. I use several investment custodians to include: Altrusit, Schwab, and AssetMark Trust. Each custodian provides niche investment solutions but also a simple, digital onboarding process

-

Step 6: Assess

Your Financial Plan is not meant to be a fancy placeholder in your library of rich mahogany and leather-bound books. We care about its contents and effectiveness throughout the year and through ever-changing conditions. Your plan includes a personalized client engagement calendar highlighting our planned reviews throughout the year and relevant discussion topics to keep the Enemies of Wealth at bay.

Most importantly, this plan is living and flexible. It WILL change. That is the benefit of working with an independent RIA and fiduciary adviser who is flexible enough to change with you.